Our mission

As valuation solely based on prices, has failed to capture collective aspirations, RQR enables the Industry to produce and finance the real estate that people desire.

How does RQR achieve that ?

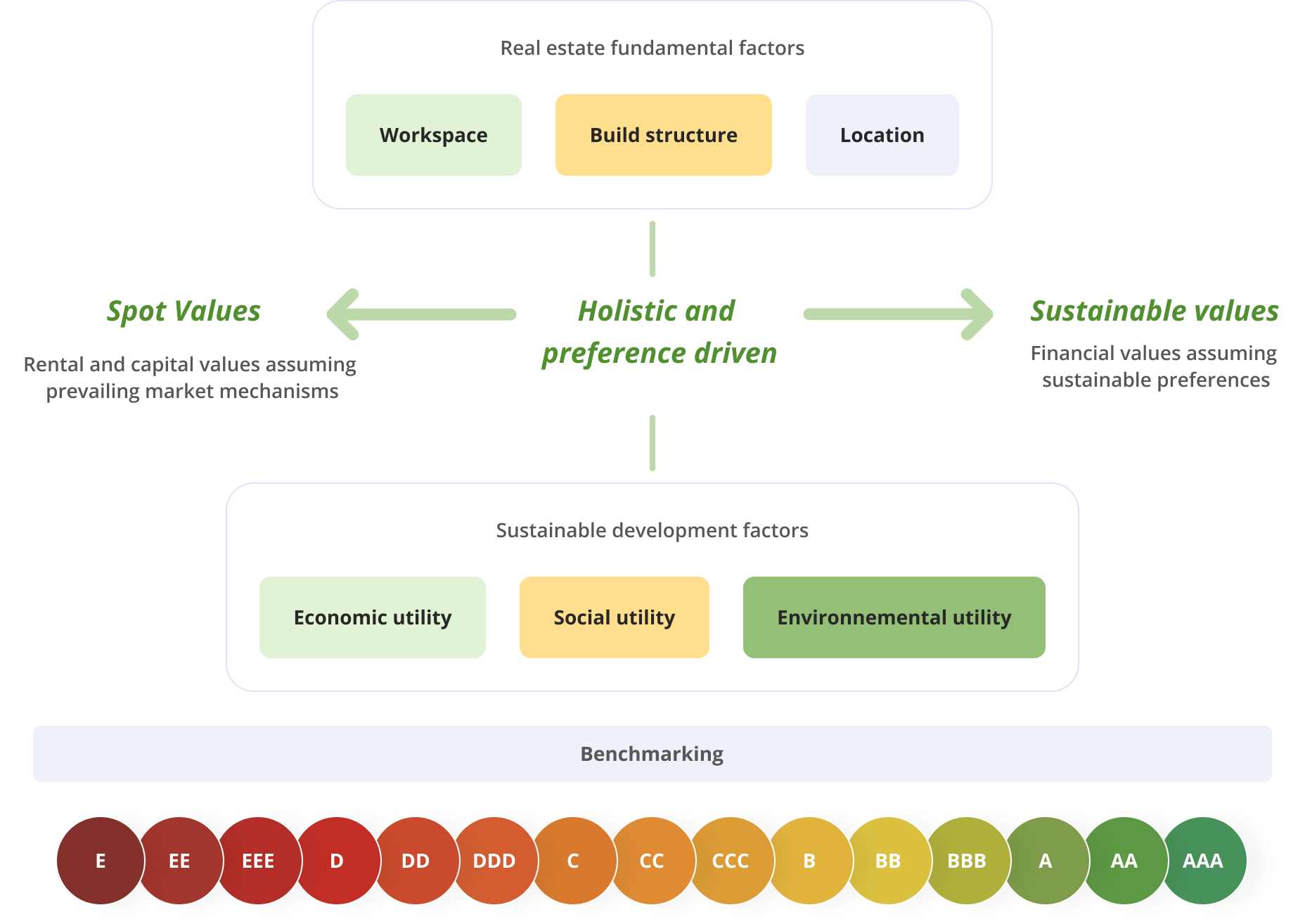

By connecting financial value to stakeholders’ sustainable preferences, thanks to a holistic and preference-driven valuation system

Executive Team

Olivier Mège

Founder, CEO

How RQR came about?

The concept of RQR has emerged from my extensive 25-year career in the asset management and financial indices industries, during which I have witnessed:

- the significant negative impacts on end-investors when they are not able to accurately measure quality (wrong investment decisions, misleading financial benchmarking analyses, wet finger valuations, etc.)

- investors’ unsuccessful attempt to create home-grown rating systems

Olivier Mège

Founder, CEO

Arnaud Simon

Scientific Director Doctor in finance, Associate Professor Paris Dauphine, Scientific Director at MeilleursAgents for 8 years

Marlène Benon

MSC in Finance, Edhec Business School, Sustainable finance and capital allocation

Taiji Shiroyama

Director RQR Japon MSC in Real Estate engineeting, Columbia University, LaSalle Investment Management, Dentsu

Patrick Singer

MSC in computer engineering, Arts & Métiers, Arquus, Thalés, Carmat, Ansaldo

Karim El Attar

Client Relations Director MSC enginering, ESTP, appraiser at CBRE

Methodological Governance

The RQR Oversight Committee is responsible for ensuring the independence and impartiality of our models, as well as maintaining consistency across multiple geographies and sectors.

Alexander Aronsohn

FRICS, RICS Director of Technical Standards and IVSC Technical Director of Tangible Asset Standards

Alex Moss

Director Real Estate Research Centre at Cass Business School, Visiting Professor at Henley Business School, and Founder of Consilia Capital

Daniel Piazolo

FRICS, Professor for Real Estate and Risk Management, THM Technische Hochschule Mittelhessen – University of Applied Sciences.

Keith Richards

Executive Director/Clinical Faculty with the C.T. Bauer College of Business at the University of Houston

Chihiro Shimizu

Professor at the Hitotsubashi University, Part-time lecturer at Nihon University, Specially-appointed professor at Reitaku University

Arnaud Simon

Associate professor and co-founder of Paris Dauphine University Center for Real Estate Management

Fabrice Larceneux

Researcher and co-founder of Paris Dauphine University Center for Real Estate Management