Executive summary

Investors are faced with the obligation to explicitly consider new factors in their decisions: the so called, sustainable development (“ESG”) factors. Now, taking these factors into account involves valuing them. However, the circularity of current valuation processes tends to be a hindrance to have these factors reflected into traditional financial values. RQR has therefore developed a valuation system that enables long-term investors to solve this problem, thanks to a value based on the market’s sustainable preferences: the Sustainable Market Value.

Assessing the impact of CAPEX on value

Assessing the impact of capital expenditures on value has always been a challenge for investors and appraisers:

- which are the expenditures that create value, as opposed to those that just enable to maintain value?

- how much value do they create beyond costs?

This challenge has become even more acute since investors have recently committed to intensify “ESG” investments, which correspond to factors that have not traditionally been reflected into valuations.

Now, if capital expenditures are not properly valued, it has for investors at least the following consequences:

- they are tough to substantiate at investment committees due to a lack of objective proofs

- they fail to be fully reflected into reported NAVs, which penalizes active asset managers’ relative returns and undermine their ability to be financially rewarded.

To address these issues, RQR has developed a dual and data-driven valuation system that:

- enables objective CAPEX valuation, including for factors that are not (or not fully) priced today

- acilitates communication with appraisers to maximize value creation reflection into NAV..

The RQR valuation system

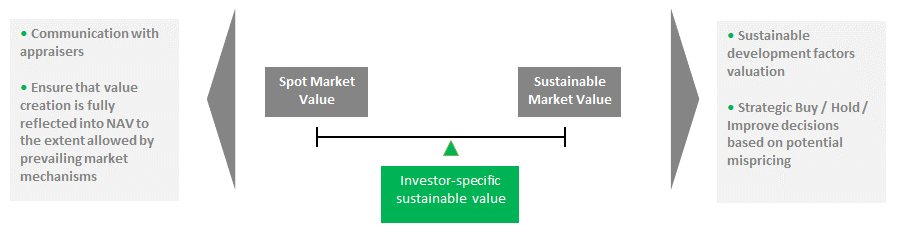

The RQR valuation system allows both the Spot Market Value for a given quality level and the Sustainable Market Value to be estimated. It allows investors to position their risk-profile specific value according to their investment horizon, between spot and sustainable value.

This system allows also to:

- Take long-term views on value

- Make trade-offs based on the relative position of spot market value vs. sustainable market value.

Sustainable vs. spot market value

This data-driven valuation system objectively assesses two types of values:

- spot market value

- sustainable market value

On the one hand, spot market value is a type of value that simply seeks to estimate a price reflecting market mechanisms prevailing just prior to the valuation date. The RQR valuation system, based on a multi-factor analysis, enhances valuations discriminatory power by allowing to reflect a greater variety of factors (beyond location), provided they are already built into market prices.

The problem with current valuation practices is that they are based on spot market value only, and that spot market value determination obeys to a circular process that is not conducive to the integration of additional factors into values.

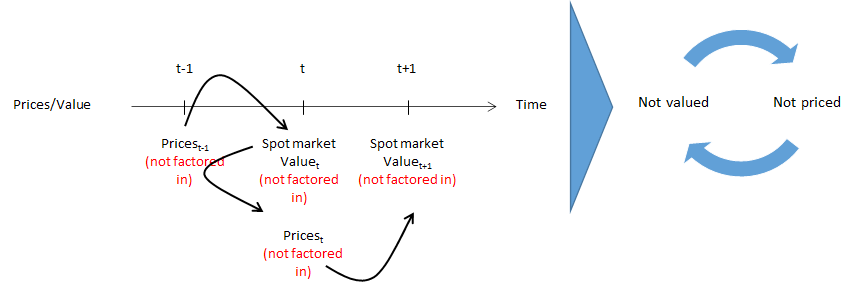

Circularity of spot market value / pricing mechanism

Circularity of spot market value: values at date t are assessed on the basis of prices for comparable assets at t-1. By definition, a new factor (not reflected into pricing at t-1) is unlikely to be valued at t, etc. This is how “mispricing” situations are perpetuated.

Consequently, spot market values alone tend not to be sufficient to value ESG investments.

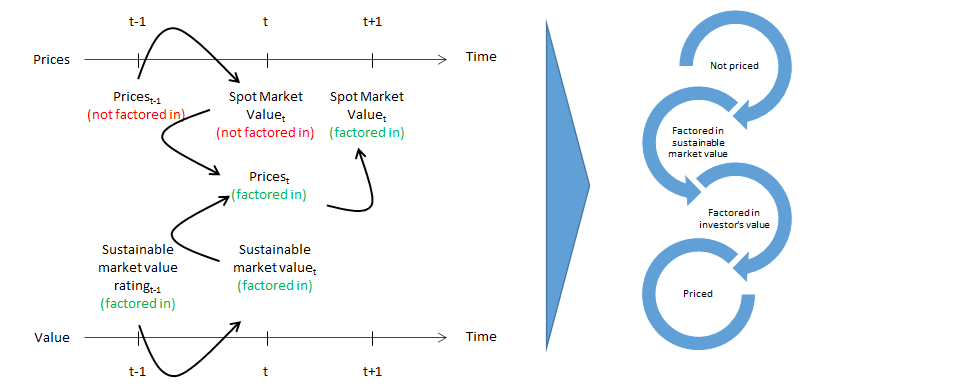

On the other hand, sustainable market value is a value that reflects underlying or implicit market participants sustainable preferences. Discovering these preferences requires surveying thousands of market participants (occupiers, investors, etc.). These preferences, that remain implicit because of market inefficiencies and lack of transparency, are revealed by the RQR’s Sustainable Market Value rating.

Sustainable market value enables investors to assess the potential value of CAPEX even though they are not priced today, provided that these CAPEX impact factors that are “valuable”, i.e., considered as important, by market participants.

Escaping from spot market circularity thanks to sustainable market value

Sustainable value allows investors to escape from the short-term vision imposed by prices and spot values. It brings to the investors’ knowledge, in an objective and quantified manner, a potential monetary value, i.e., one that is likely to be realised in the long term (reversion). This allows investors to make bets on value.

ESG investment valuation use case

Let’s take for illustration purpose the following scenario.

The owner of a multi-let office asset located in the Paris region plans to improve energy efficiency to achieve the CRREM 2°C energy intensity trajectory by 2030. We assume that this improvement is not priced on the leasing market.

Initial state and CAPEX program

| Location | Paris Region |

| Multi-let office building | |

| Total floor area | 14,500 |

| Leasable area (m²) | 11,600 |

| ERV spot before works (€/m².year) | 500 |

| CAPEX (€) | 3,000,000 |

As a result of implementing the program, energy intensity is nearly divided by a factor 2. The pay back of the net income increment resulting from energy savings is much too long to justify the investment.

Impact and pay-back period

| Energy consumption before works (kwh/m².yr) | 290 |

| Energy consumption after works (kwh/m².yr) | 150 |

| Energy price (€/kwh) | 0.174 |

| Total energy savings (€/year) | 353,220 |

| Asset owner’s share of total energy savings | 35,322 |

| Pay back (years) | 85 |

From a capital value point of view the multiple of appraisal value increase to costs is lower than 1x. Consequently, the investment should be rejected.

Return on capital assuming spot market value

| Market cap rate | 4,0% |

| Appraisal value capital increase | 883,050 |

| Appraisal value gain / CAPEX | 0.3 X |

Now, sustainable market value is expected to increase by 30 euros per square meter (up to 530 €/m2.yr), as a result of the improvements. Capitalized with a cap rate that reflects the risk premium stemming from the additional risk taken in relation with the bet on reversion, the potential sustainable value increment translates into a nearly 3x investment multiple.

Return on capital assuming sustainable market value

| Reversion risk premium (bps) | 100 |

| Sustainable capital value gain | 8,700,000 |

| Sustainable value gain / CAPEX | 2.9 X |

Consequently, assuming reversion to sustainable market value during the holding period, the investment can be considered as potentially attractive.

How will this system contribute to price reversion to sustainable market value?

The concept of sustainable market value shares commonalities with the equity market Fundamental Value concept, based on which investors conduct trade-offs also called long/short strategies. The assumption that underpins these strategies is that prices will revert to fundamental value over time, because market participants are chasing inefficiencies.

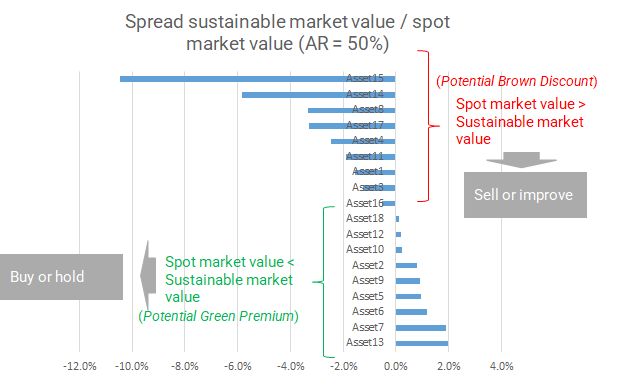

Trade-offs based on spot market value relative to sustainable market value

AR stands for Adhesion Rate. It is the ratio that represents the position of the investor-specific value between spot market value and sustainable market value. When the ratio equals 1, it means that the value retained equates sustainable value, and that the magnitude of the bet is maximum. Conversely, when AR equals 0%, it means that the value retained equates spot market value.

These bets will be less risky for long term investors as, the longer the investment horizon, the greater the probability that price reversion to sustainable value occurs during their holding period. A pension fund, for example, with a very long holding period will have a high probability that reversion to market sustainable value takes place during the holding period. This is not the case for shorter-term investors, and these investors take a greater risk if they value investments too close to sustainable market value. At the extreme, opportunistic investors may even just be happy with spot market value.

For that reason, a key feature of the RQR valuation system is that it enables investors to calibrate the position of the investor-specific value between spot and sustainable market value.

Conclusion

The RQR valuation system, combining spot and sustainable market value, will enable investors to:

- Value ESG investments, in a way that is consistent with their risk profile

- Enhance their communication with appraisers about value creation, and generate active management outperformance

- Identify mispricing opportunities with acquisitions and held assets and derive arbitrage profits.

At market level, sustainable market value is a fundamental value discovery mechanism. It enables to escape from the circular logic of current pricing mechanism and to integrate sustainable value factors into value, provided that they are deemed important by market participants.

Sustainable market value credibility is backed by the scientific rigor and independence of the organization that assesses market participants’ underlying preferences. By providing arbitrage opportunities and positive incentives to sustainable value creation projects, such a system will contribute to more efficiently put money at work to achieving collective goals in relation with economy, society and environment.

About

RQR Global

RQR is the world leader in sustainable value rating for real estate assets. RQR provides professionals with valuation and decision support tools, intended to reconcile sustainable development and financial performance.RQR is the world leader in sustainable value rating for real estate assets. RQR provides professionals with tools to help with valuation and decision-making, intended to reconcile sustainable development and financial performance.

Disclaimer

All right, title and interest in this document and all content contained herein is the exclusive property of RQR, except as otherwise stated. You may not modify, copy, distribute, transmit, display, perform, reproduce, publish, license, create derivative works from, transfer, or otherwise use or exploit in whole or in part any information obtained from this document, except for the purposes expressly provided herein, without RQR’s prior written approval. If you use any part of this document, you agree that you will not remove or obscure any copyright or other notices or legends contained therein.

You are also prohibited from using any information, calculation, concept, definitions, outcomes used in this document without the written permission of RQR (including the names of all RQR ratings, outcomes and products).